Cryptocurrency traders lost nearly $1 billion in 24 hours amid market crash

Nearly 300,000 cryptocurrency traders lost close to $1 billion in the last 24 hours following a significant market crash. Cryptocurrencies experienced significant losses on April 12 and altcoins unusually dominated cryptocurrency liquidations, over Bitcoin (BTC).

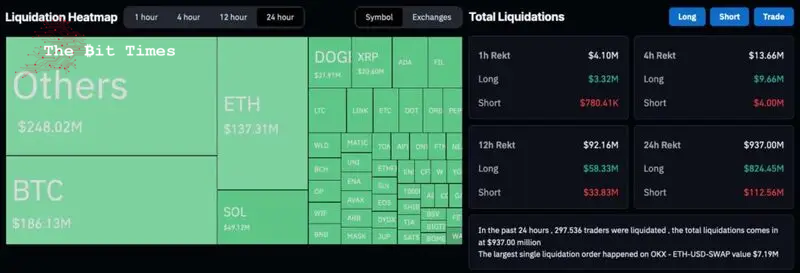

Precisely, 297,536 derivatives trading positions reached the liquidation threshold, for $937 million of daily total losses. Finbold retrieved this data from CoinGlass‘s liquidation heatmap on April 13.

On that note, long positions made the vast majority of these losses, summing up to $824.45 million in liquidations. Short positions represented 12% of all losses, for $112.56 million.

Picks for you

Interestingly, $248.02 million of these liquidations happened with “other” altcoins, outside of the top 50 most valuable cryptocurrencies. This is an unusual leadership, considering Bitcoin and Ethereum (ETH) often dominate the trading volume and, consequently, the liquidations.

Crypto market crash analysis

As of writing, TradingView‘s total crypto market cap index displays a $2.384 trillion valuation. This is a $142 billion lower capitalization than the $2.526 trillion registered a day before, on April 12.

However, the 5.6% losses of the above are still better than the ‘Total 3’ index – excluding Bitcoin and Ethereum. These altcoins lost over $66 billion out of a $730 billion market cap, or 9%, in the same period.

Now, the ‘Total 3’ registers a $664.27 billion capitalization and represents nearly 28% of the cryptocurrency market. Bitcoin dominates the landscape by over 55% and Ethereum has the remaining 17%.

Cryptocurrency traders liquidations: Why they happen?

When cryptocurrency traders open a long or short position in the derivatives market, they start a contract betting on the cryptocurrency’s future price.

For that, traders deposit and commit with collateral, agreeing upon a liquidation price of the underlying asset they are betting into. If the cryptocurrency reaches the agreed price, the exchange closes the contract, liquidating the collateral.

This highlights some of the risks of operating in the derivatives market, in particular with Futures trading. On the other hand, buying cryptocurrencies in the spot market prevents investors from liquidation and is known as a more conservative and organic approach to cryptocurrencies.

Comments

Post a Comment