Top Bank's 2024 Bitcoin Price Prediction Sounds Outrageous

Bitcoin’s Bullish Factors

The most recent crisis to hit the banking industry in the United States has lately sparked a price boom in Bitcoin and indirectly re-established its primary use case “as a decentralized, trustless, and scarce digital asset,” according to the bank. Additionally, Kendrick pointed out a number of other parameters which he thinks would fuel the price of Bitcoin which includes the fact that the Federal Reserve would no longer be raising interest rates, the fact that the supply bitcoin would be halved again, and that regulatory benefits making into UK and USA would finally be realized.

Read More: Do Kwon’s Latest Move Against U.S. SEC Could Be Game Changing, But Is It Enough?

According to Standard Chartered, the fact that the Federal Reserve of the United States is drawing closer to the conclusion of its cycle of interest rate hikes should be favorable for risk assets in general. Bitcoin, being the king of risk assets, tends to benefit from such a development. Moreover, its increasing connection to the Nasdaq stock market at the present time suggests that the leading cryptocurrency should trade even better if risk assets were to improve more generally. However, Bitcoin’s ability to trade higher during bad periods for risk assets does not preclude it from doing so.

Bitcoin’s Upcoming Halving

The World’s first licensed Crypto Casino. Begin your journey with 20% cashback up to 10,000 USDT.

Trending Stories

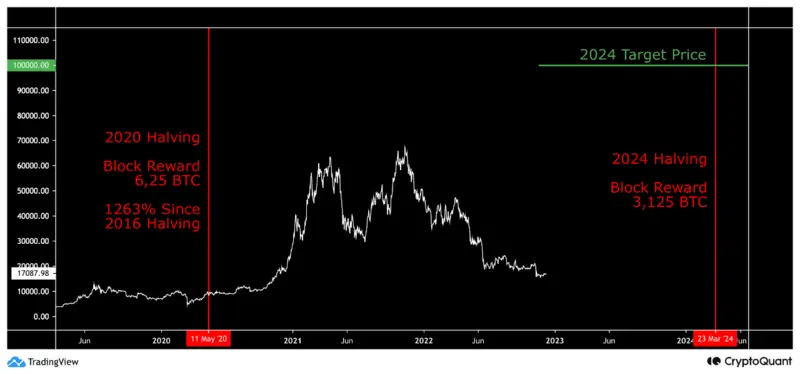

The uniqueness of Bitcoin lies in its code. The coding behind the largest cryptocurrency by market cap is designed to ensure that the rate of supply expansion slows down over time. And it’s these in-built halving events that have lent an impact on the price of Bitcoin previously. Because the source code is publicly available, simple calculations determine that the reward for a Bitcoin block is halved every 210,000 blocks, which is equivalent to around once in every four years.

When looking at historical information, we can see that the spot price of Bitcoin has climbed by 1,263% between the 2016 and 2020 halvings. If the current trends continue as they are, the price of Bitcoin will reach $120,263 on the 23rd of March in 2024 which is in line with Kendrick’s Bitcoin price prediction.

On Sunday , the price of Bitcoin dipped below $27,000 for a short period of time as the broader crypto market continued its decline for five consecutive days. As things stand, Bitcoin’s price is currently exchanging hands at $27,348 which represents a drop of 0.43% over the past 24 hours in comparison to a loss of 7.47% recorded over the past seven days.

Also Read: Binance.US Sparks Optimism As It Lists Floki (FLOKI), Is A Meme Season In The Making?