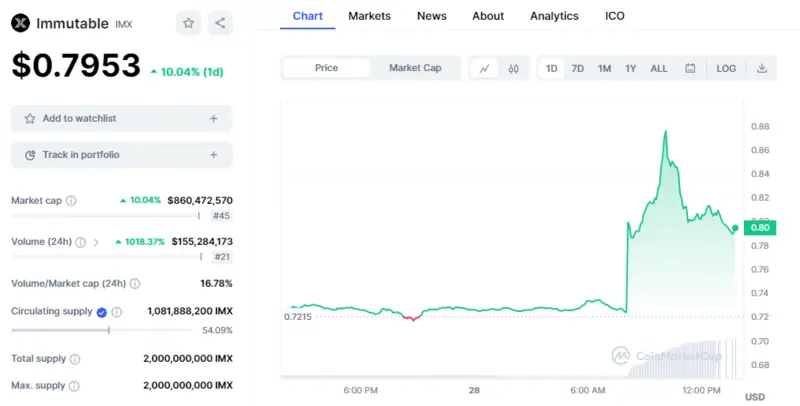

Immutable (IMX) Price Skyrockets 15%, Here's Why

Why is Immutable (IMX) Token Surging?

The catalyst of the price action was a declaration that the South Korean cryptocurrency exchange Upbit would list $IMX in its Korean Won market. Despite the crypto market’s continuous consolidation phase, the increase of more than 58% from its lowest point in June this year took place, making $IMX a light in a generally dreary market.

At 4:00 UTC on July 28, Upbit’s $IMX trading started, and the exchange only accepted $IMX deposits from the Ethereum network. This noteworthy development sparked the token’s meteoric growth and solidified its place as a dominant force in the cryptocurrency industry.

Immutable X, which offers APIs and game creation tools for NFT and Web3 games, specializes in NFT minting and trading. Its native token, $IMX, allows token holders to stake $IMX and participate in governance decisions in addition to serving as a governance and utility token for paying fees inside the ecosystem.

Recommended Articles

Also Read: Why The Falling Wedge Is Undeniably Bullish for Bitcoin Price?

More Partnerships For Immutable

For $IMX, there was additional good news. Immutable X announced a strategic alliance with Helika Analytics, which led to a further increase in the token’s value. The agreement will give Immutable ecosystem designers the ability to conduct in-depth Analysis utilizing Helika’s no-code tools, which is widely seen as a big improvement to the ecosystem’s usefulness.

Immutable X has undoubtedly caught the attention of the cryptocurrency community with this dual wave of listing news and strategic cooperation. Both professionals and enthusiasts will be closely monitoring its course as the market moves through the ongoing consolidation phase. Is this the start of $IMX’s rise, or is there more to come? Time will only tell.

Also Read: Binance Calls Out Regulatory Overreach by CFTC, Asks Court to Dismiss Lawsuit