Impending altseason looms as Ethereum outperforms Bitcoin price action

The cryptocurrency market has experienced significant volatility in recent months. However, Ethereum (ETH) has demonstrated notable strength against Bitcoin (BTC), reclaiming a key trend line and sparking discussions of a potential altseason.

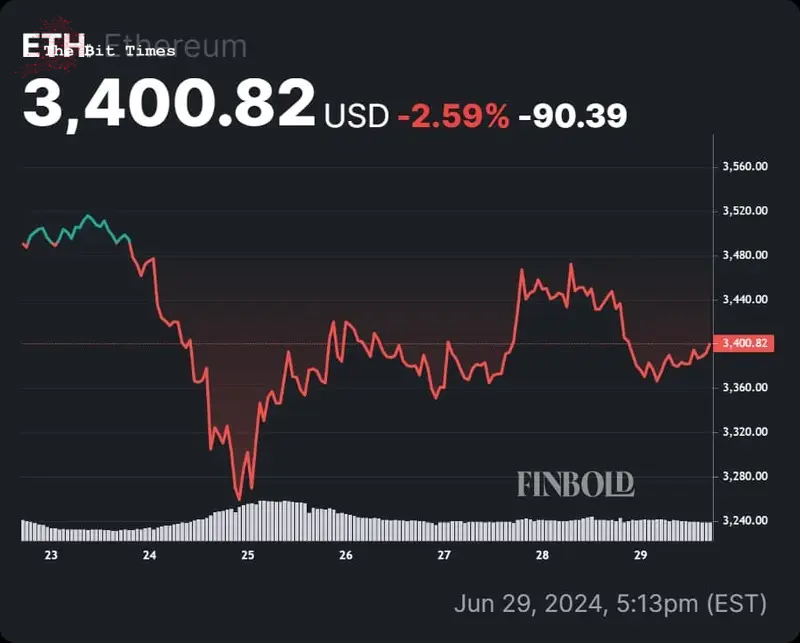

While both cryptocurrencies have faced selling pressure, Ethereum’s price has dropped below $3,400, and Bitcoin has declined by 5.8% over the past week. Despite this, Ethereum’s decline has been more modest at 3.5%, indicating a stronger relative performance against Bitcoin.

Indicators of an altcoin market resurgence

Several analysts are now predicting a potential resurgence in the altcoin market. This prediction is based on historical patterns and market indicators that suggest a turnaround may be on the horizon.

Picks for you

Specifically, with the ETH/BTC pair reportedly on the verge of a significant breakout just before the spot Ethereum exchange-traded funds (ETFs) go live next week, there is growing anticipation of an impending altseason.

Additionally, Ethereum’s relative illiquidity compared to Bitcoin is notable. Ethereum is roughly one-third the size of Bitcoin in market capitalization but only about 10% of its liquidity. Thus, an influx of $3-4 billion could notably boost Ethereum’s price.

Technical insights and analyst perspectives

Examining the ETH/BTC price chart from March to June 2024 reveals several key insights. The pair has experienced significant fluctuations, with notable peaks in early March and June 2024, indicating periods when ETH significantly outperformed BTC.

This suggests that Ethereum has been able to capture more market interest during these periods, likely due to favorable developments and growing market sentiment.

Crypto market analyst Ali Martinez highlights that ETH/BTC is finally moving above the 365-day Simple Moving Average (SMA). This is a critical indicator often signaling the beginning of a bullish trend for Ethereum relative to Bitcoin.

In recent weeks, ETH/BTC has shown a robust upward trajectory. From a low in mid-June, the ratio has surged, now standing at approximately 0.05571 BTC. This upward movement indicates growing market confidence in Ethereum relative to Bitcoin and suggests a potential trend reversal.

If the ETH/BTC price continues to rise and breaks the long-term descending trend line, it could confirm a significant trend reversal. This movement above the 365-day SMA can be seen as an early indicator of an altseason, where altcoins like Ethereum outperform Bitcoin.

Renowned analyst Michael van de Poppe shares a similar view, stating that the bull market has already started. He emphasizes that Ethereum breaking through the 0.06 BTC level could attract substantial capital inflows, further boosting its price.

Similarly, Crypto Nova, another respected analyst, concurs that the ETH/BTC ratio is poised for a substantial increase. This shift is expected to catalyze broader movements in the altcoin market, driving gains across various cryptocurrencies.

Further bolstering positive sentiment is the upcoming launch of Ethereum ETFs. Expectations for $500 million of inflows over the next six months are setting the stage for a potential bullish run, as reported by Finbold.

Current Ethereum price and future outlook

At the present time, Ethereum is trading at $3,391.63, with a 1.5% change in the past 24 hours and a 9% decrease over the past month.

Overall, Ethereum is getting green lights from all angles, indicating a robust and potentially lucrative period ahead for investors.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Comments

Post a Comment