Chainlink Doubles Investor's Money: Should You Invest in LINK Now?

The bulls are back in the cryptocurrency market, as leading altcoins are hitting new yearly highs. Leading altcoin Chainlink went from a low of $10 to a high of $26 this week, attracting heavy bullish sentiments. LINK is now hovering around the $24 mark after rising nearly 125% in the last 30 days. Investors who took an entry position after Trump won the election in early November are all sitting in profits.

Also Read: MATIC: After Rising 150%, Can Polygon Double Your Money Again?

Chainlink sustainably scaled up in the indices, generating gains for traders almost every week. However, its price cooled down this week and is mostly trading sideways in the charts. In this article, we will highlight whether this is the best time to accumulate LINK in your portfolio.

Also Read: Cardano: AI Sets Double-Digit Gains For ADA

Chainlink: Buy LINK Now For Profits?

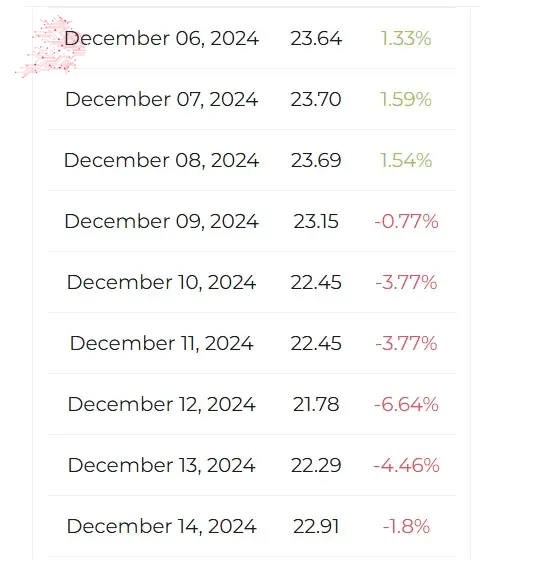

Leading on-chain metrics and price prediction firm Changelly has predicted that Chainlink could cool down in price this week. According to the price prediction, LINK could trade sideways, having little to no price spurts in December 2024. The forecast indicates that Chainlink could shed another 3% to 6% of its value this week.

Also Read: Vechain Skyrockets 35% Today: VET To Reach $1 Next?

LINK could dip to $22 by mid-December, and an investment of $1,000 today could fall to $950. Its price could fluctuate between $24 to $20 and leave investors impatient this month. “In the middle of autumn 2024, the Chainlink cost will be traded at the average level of $22.61. Crypto analysts expect that in December 2024, the LINK price might fluctuate between $20.57 and $24.65,” read the price prediction.

Also Read: Ripple XRP Outperforms Bitcoin, Solana: $3.40 Soon?

However, buying the dips on Chainlink could prove beneficial as the cryptocurrency market is hopeful that Trump could usher the digital asset industry into a new financial era. Trump is handpicking crypto-friendly appointees to his cabinet that could favor the markets. Therefore, buying at the dips could be beneficial as the next four years could bring positive changes to the markets.

Comments

Post a Comment